Commercial Assurance Reporting

Document

type: Micro-report

Author:

Richard Wood BSc MRICS

Publication

Date: 26/02/2016

-

Abstract

A programme controls approach was needed to integrate commercial management information, to support decision making at the programme and sector level. Periodic Programme Controls Working Group meetings, combined with data and trend analysis, facilitated a good understanding of commercial performance across each of the programme controls functional areas, allowing areas of commercial risk to be highlighted and explored, and targeted improvement action plans to be developed. This document outlines how commercial indicators can be used to better profile commercial risk, better informing management action and intervention. This document is relevant to any project developing and setting up an approach to measuring commercial performance, or developing initiatives to improve commercial performance during the delivery phase.

-

Read the full document

Introduction and Industry Context

From the outset, it was essential for the Crossrail team to provide assurance to stakeholders that Crossrail could be delivered on time and within budget.

A programme controls approach was needed to:

- integrate management information – commercial and programme controls,

- provide key programme controls knowledge at Programme and Sector level (contracts categorised by work type: Civils, Stations, Systems) in a coordinated manner

- facilitate data and trend analysis

- Bring together data sources into a single dashboard to facilitate informed decision-making, focused on successful delivery and to drive targeted commercial assurance activities where required.

Programme Controls Working Group

A periodic Programme Controls Working Group (PCWG) was established, made up of the individuals with primary responsibility for operating programme controls and the commercial assurance process. The key members of the PCWG are detailed within the Commercial Assurance Procedure. In order to provide the PCWG with the information necessary to inform programme direction and decision making in relation to Programme Controls and Commercial management a Commercial Indicator Report (CIR) was established.

Commercial Indicator Report (CIR) – Project Data

The CIR reported the commercial performance of the largest, most complex contracts through key performance indicators covering all aspects of commercial management. The report utilised ‘lead’ and ‘lag’ indicators and trend analysis to assist in the identification of areas of potential commercial risk, utilising a ‘RAG’ ranking (below) .

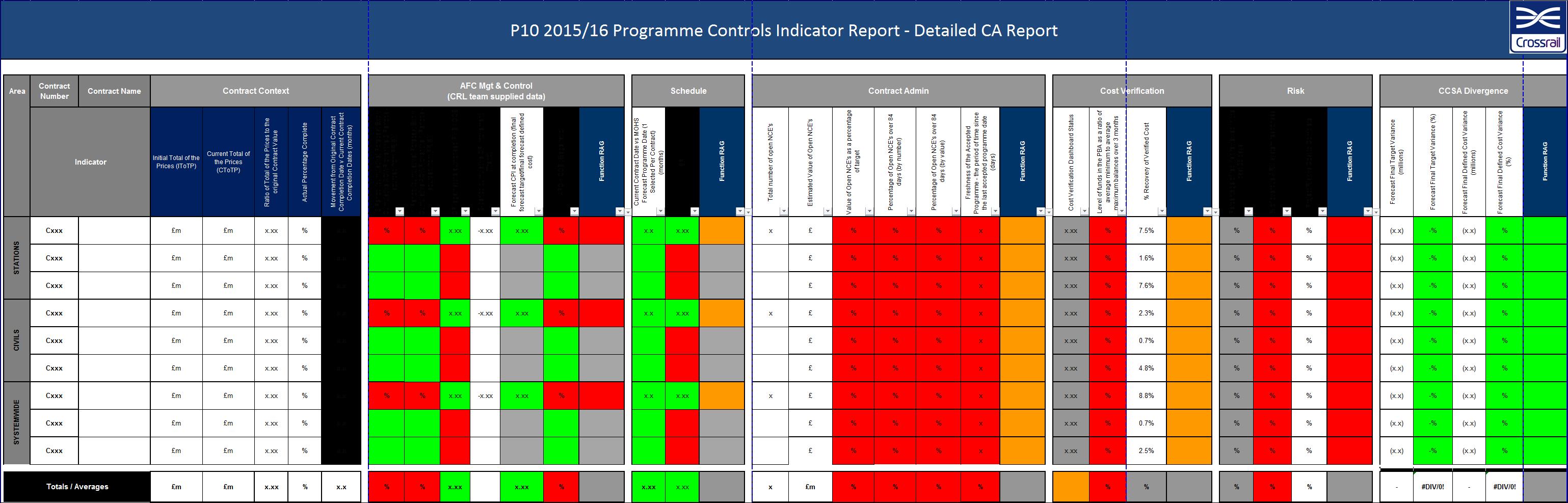

Figure 1 – Commercial Indicator Report snapshot of functional indicators

Indicators were refreshed at key intervals to ensure alignment with the stage and challenges of the Programme. Indicators which were used included:

Indicator Red Amber Green Forecasting accuracy >15% +/- 15% 5% Cost Performance Index (CPI) trends <0.95 0.95 – 0.99 1.0 or greater AFC vs. Budget >115% 105% – 115% <105% Forecast milestone completion dates vs. planned dates >3 months 1 – 3 months <1 month Schedule Performance Index (SPI) <0.95 0.95 – 0.99 1.0 or greater Value of open change items as a percentage of the total contract value >10% 5% – 10% <5% Percentage of ‘aged’ change items >40% 21% – 40% <20% Freshness of the accepted programme >84 days 29 – 84 days <28 days Utilisation of the Project Bank Account – percentage remaining >30% 21% – 30% <20% Percentage of key risks reviewed <75% 75% – 94% >95% Percentage of overdue risk mitigation actions >20% 1% – 20% 0% Divergence between the Crossrail project team and Contractor with regards to the anticipated final contract value and Defined Cost amounts >15% 5% – 15% <5% Central Data Warehouse

Standardised data for these indicators for each contract was collated from a central data warehouse to ensure consistent data capture and alignment to the ‘single source of truth’. The data warehouse is described in more detail elsewhere on the learning legacy website.

Queries

Queries were generated by the Programme Controls team and distributed to the project teams to understand key commercial performance concerns, and trend analysis was undertaken across each of the commercial functions to highlight areas of commercial risk at a Project, Sector and Programme level.

Figure 2 – Commercial Indicator Report snapshot of summary page

Trend/data analysis

The CIR, including trend analysis commentary and all query responses, was issued periodically ahead of the PCWG, and any key trends were discussed during the periodic meeting. This allowed the PCWG to assess the performance of the programme at a higher level and identify where general programme improvements needed to be made.

Performance Improvement actions

Performance Improvement actionsFollowing the PCWG, the CIR was issued in a final version, recording agreed improvement actions to address any identified performance risk.

Additional Assurance Activity

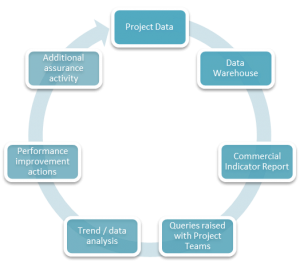

The analysis and review of these metrics also informed the plan for targeted functional / Deep Dive commercial assurance activities on a risk-based approach, including AFC Deep Dive reviews and cost and controls reviews. This process is demonstrated in the adjacent graphic.

Lessons Learned

The PCWG and CIR worked well in tandem to facilitate a good understanding of commercial performance, allowing areas of commercial risk to be highlighted and explored, and targeted improvement action plans to be developed. It also allowed commercial performance to be assessed at functional, Project, Sector and Programme level. This was also useful in establishing requirements regarding further commercial assurance activities for specific issues at these different levels to improve performance.

Initially, the PCWG was conducted at a Programme level, with all projects assessed each period. This gave a broad overview of key issues at Programme level, but did not allow time to review key issues and trends in sufficient detail at a Sector or Project level. In order to make the PCWG more focused, it was decided to hold Sector-specific meetings on a rotational quarterly basis. This allowed the CIR analysis to be more focused on trends specific to the Sector whilst still providing an overview of overall Programme performance. It also facilitated more time within the sessions to have targeted discussion of key commercial risks to allow improvement actions to be developed and more targeted assurance activities to be arranged. To reflect this change, the CIR trend analysis provided a summary of trends across the Programme, but then contained more detailed analysis of trends and data for the Sector being discussed that period. A key lesson learned was to ensure that all actions were allocated to those with accountability for ensuring improved performance, were SMART, and were tracked and acted upon.

Recommendations for Future Projects

Future projects and programmes would benefit from establishing a similar commercial indicator report and assurance working groups in order to ensure that the individuals with primary responsibility for operating programme controls and the commercial assurance process have access to robust commercial performance data to aid decision making. This should:

- include indicators which cover all commercial aspects, aligned to the overall commercial objectives

- provide an overview of programme performance but be focused enough to drive meaningful discussion of commercial risks and mitigating actions

- involve key people who are accountable for successful commercial assurance and delivery for the programme / their respective areas

- establish SMART actions, which should be tracked and monitored to ensure that they are completed as required, and

- be used to inform further, more detailed commercial assurance activities following a risk-based approach.

-

Authors

Richard Wood BSc MRICS - Crossrail Ltd, Turner & Townsend

Associate Director – Turner & Townsend

Head of Cost and Control, Crossrail

Richard has over 10 working on the UK’s major infrastructure projects and programmes, including leading an integrated cost and controls managed service on the £2.5bn T2 redevelopment scheme at Heathrow, and played a key role in establishing cost and controls processes on their £3bn Q6 programme. Richard has worked on Crossrail since 2014, and has held several positions over this time, including Head of Commercial Assurance and Head of Performance Assurance. Richard took on the role of Head of Cost and Controls in March 2017.