Contingency Management

Document

type: Micro-report

Author:

Walter Macharg MA FCA

Publication

Date: 27/09/2016

-

Abstract

This micro-report describes how contingency budgets were established, delegated and managed by Crossrail, and the different categories of contingency budget. It explains the link between contingency and risk management, and control systems.

-

Read the full document

Introduction and industry context

The Crossrail approach to contingency management was developed following research into the processes adopted by comparable organisations including the Olympic Delivery Authority and Network Rail. The process was designed to deliver:

- Allocation of contingency to the different levels of the organisation: Sponsors, Crossrail Board, the top level Programme, and Projects.

- A clear definition of which risks are to be managed at each organisational level and funded by which category of contingency

- Strong governance around the process for allocating contingency.

Establishing the contingency budget

The Crossrail Programme Baseline of scope, time and cost was established in 2011. The cost baseline was derived from a comprehensive cost estimate which was analysed into the work breakdown structure. Forecast risk was derived from the quantitative risk analysis, and costs were inflated and time phased using the Crossrail investment model.

This cost baseline was established as the Programme budget, broken down into a budget at point estimate for each planned contract work package within the work breakdown structure. The total contingency budget available to the Crossrail Programme was established as the headroom between the total point estimate for the works and the Sponsor committed funding, as defined by the Project Development Agreement (PDA).

The contingency available to Crossrail was divided into:

- A contingency budget to be controlled by the Programme

- The balance of contingency budget, to be controlled by the Crossrail Board.

The budget analysed into the work breakdown structure, including Board and Programme contingency, was approved by the Crossrail Board in March 2011 and was recorded in the financial systems. All subsequent changes to this baseline budget were made under Programme Change control.

Disaggregating contingency

The work breakdown structure allocated scope and cost to contracts. The organisation breakdown structure grouped contracts into Projects, and Projects into Sectors – groupings of Projects by geography or engineering discipline. This is explained in the Learning Legacy micro-report on the Work Breakdown Structure. Part of the Programme Contingency was delegated to each of the Projects and Sectors.

A risk matrix was established, defining the risks to be owned at the different organisational levels of Board, Programme, Sector and Project. Risks were allocated to each level and evaluated through the Quantitative Risk Assessment (QRA) process.

Contingency was disaggregated to Sectors and Projects, under change control, to fund risks allocated at each organisational level.

The QRA was continually updated through the course of the project, and the expected outturn values of risk were monitored against remaining contingency budgets at each level of the organisation. The QRA process will feature in a future learning legacy document, however it is outlined on the Risk Management learning legacy sub-topic page.

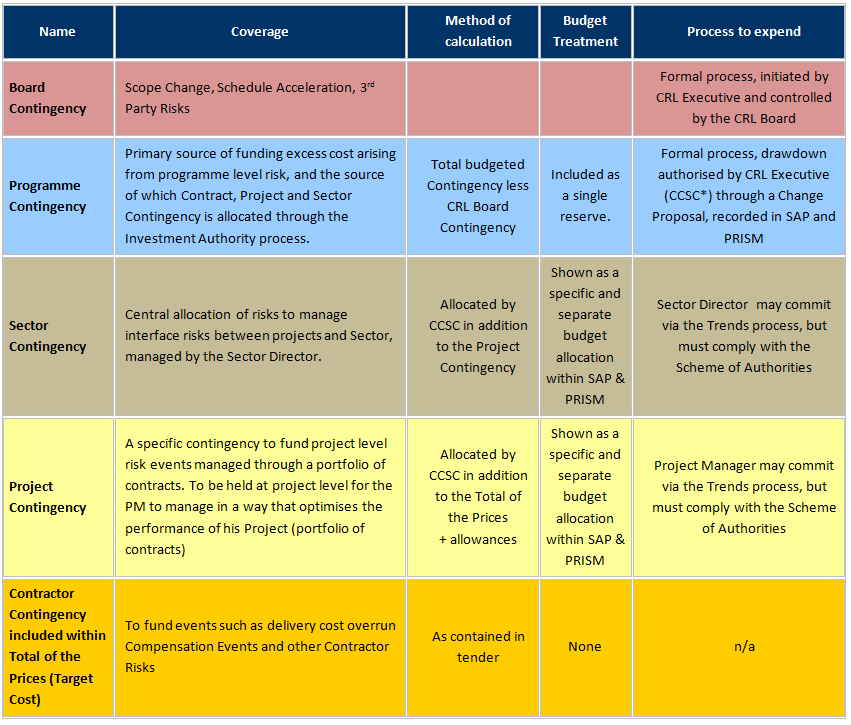

*CCSC = Commercial and Change Sub-Committee, the Programme change control authority

Table 1 – Disaggregation of Contingency

Managing contingency

The Project Contingency was held at project level for the Project Manager to draw down via budget transfer into contract budgets as risks and changes materialised. Holding contingency at project level provided the Project Manager with the agility to make best use of the available funds in managing the project as a portfolio of contracts. The Project Manager’s authority to draw down contingency was limited at the transaction level by formal delegation of authority by the Board of Directors. The Scheme of Authorities established monetary limits for transactions which could be approved by post holders, with escalation as required, ultimately to the Board.

The Project Manager was responsible for establishing a realistic forecast Anticipated Final Cost (AFC) and for determining how best to utilise Project Contingency in order to mitigate the impact of AFC increases. The Project Manager was required to monitor the rate at which Project Contingency was being drawn down into contracts to ensure that sufficient Project Contingency remained available for the remaining works within the project.

Categories of budget

Three categories of budget were defined:

Current Control Budget (CCB)

The performance budget which was the basis of the planned value for earned value management. Varied for scope change or other Programme risks, but not for cost overspend. This ensured that earned value measures remain meaningful.

Investment Authority (IA)

The authorised limit of expenditure for a Contract, Project or Sector. This established the limit up to which a purchase order can be raised, therefore the maximum amount that can be paid to the Contractor.

Pre-Tender Budget Authority (PTBA)

The expected financial impacts of packages before tender documents were issued. Recorded outside the financial systems.

All types of budget were allocated under Change Control, approved by the Commercial and Change Sub-Committee of the Board. The baseline budget for each contract within the WBS formed the initial Current Control Budget. Pre-tender budget authority was required as a check on affordability before procurement. Once a tender was accepted, IA was granted, and the CCB re-set; CCB and IA would normally be the same value at this stage. Contingency was allocated to the Project at this time; contingency was normally a targeted amount, taking the QRA risk estimate at P50 into account, but not normally the full P50 value.

Projects could return to change control for increased contingency budget. An increase to CCB and IA would normally be granted for scope change and Programme risk, but IA only would be granted for cost overspend. Accordingly a Project could have a sanction to spend that was higher than its CCB. The CCB would continue to be used as the planned value for earned value calculations. This maintained the integrity of the earned value measures.

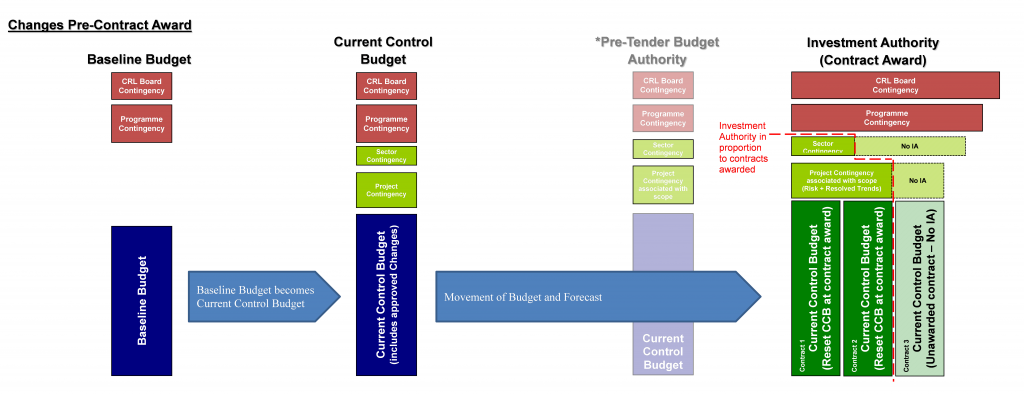

*Pre-tender budget authority recorded outside financial systems so greyed out here.

Figure 1 – budget allocation as contracts awarded

Financial systems

Robust and comprehensive finance systems were essential for effective management of budgets and contingency.

Budgets were established in the cost breakdown structure in both the SAP finance system and the Prism cost management system. Whilst the standard Prism system specification was implemented, a change management module was developed in order that change could be managed through a trend process. Trends were system transactions to amend Anticipated Final Cost, transfer budgets, draw down from contingency budgets, and track Compensation Events to change contract prices. Trends required approval by the appropriate manager within the organisation breakdown structure, up to the manager’s level of delegated financial authority. Thus full control of authority and audit trail was maintained in the Prism system. Budget, AFC and ACWP (Actual Cost of Work Performed) balances were mirrored from Prism into the SAP finance general ledger at each financial period end.

Lessons learned

The allocation of risk to the appropriate level of the organisation and the allocation of contingency enabled risk to be managed under delegation, increasing Project Managers’ ownership of cost.

An essential enabler was the alignment of cost and finance systems, with a consistent work, cost and organisation breakdown structure.

Under the QRA process the expected value of risk was regularly compared to contingency balances to identity potential funding shortfalls.

The distinction between performance budget and expenditure authority avoided the situation where an overspending project’s CPI returns to 1 when its budget is resanctioned. However in practice it was difficult to distinguish between changes which should change CCB and IA and those which should attract IA only. The maintenance of two budgets in the finance systems added complexity.

The pre-tender budget authority process was intended to prevent work packages going out to tender which were not likely to be affordable within the available funding. In practice the costs were tested in the tender process, which generally resulted in initial budgets that were within funding. However budgets established in the competitive tender process were low in some cases, and budget increases were required as works progressed.

All changes to budgets were subject to formal change control under the authority of an Executive Sub-Committee, which assured appropriate challenge. Having a single sub-committee ensured efficiency in the management of change as well as improved consistency and quality of change requests.

Recommendations for future projects

Delegate contingency budgets to appropriate levels of the organisation, and specify which risks are to be managed at each organisational level.

Formally control all changes to budgets, recorded by robust financial systems. This should include electronic system workflows to align with the agreed governance and delegated authority arrangements.

Financial systems will generally permit the maintenance of different categories of budget, for example: performance budget, expenditure limits, annual budget, long term business plans. Consider whether governance is improved by maintaining different types of budget, and if this justifies the increased complexity of budget management.

-

Authors

Walter Macharg MA FCA

Responsible for managing the Programme Change Control process for Crossrail, which controls the high level scope and requirements documents and delivery budgets. A Chartered Accountant, formerly a PLC Group Financial Controller, followed by ten years in financial roles in Network Rail. Previously Crossrail’s Head of Financial Control, he moved into Programme Controls in 2012, where he established the cost verification function under the NEC3 contracts, and leads the Programme change process.